Problem Description

Fintechs must continuously detect, investigate, and report suspicious activity across high-volume transactions. Manual rule checks, sanctions screening, and narrative-quality SAR drafting are slow and inconsistent. A coordinated network of Syncloop-powered agents automates end-to-end AML: risk signals from activity streams, sanctions/PEP/adverse-media screening, network analysis, case triage, and SAR narrations—while maintaining a clean audit trail.

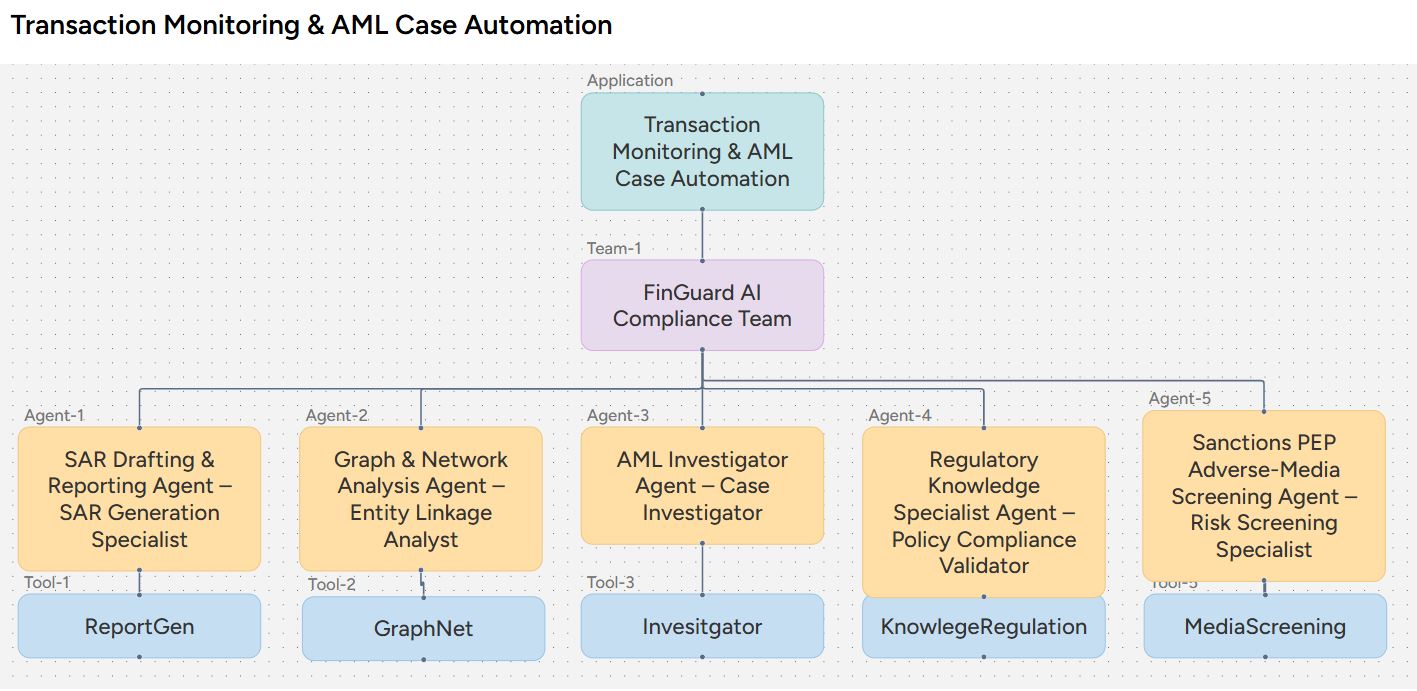

How It Works

Specialized agents run in parallel via Syncloop. A Monitoring Manager orchestrates transaction ingestion and alert creation, a Screening Agent handles sanctions/PEP/adverse media, a Graph/Network Analyst studies entity linkages, an Investigator synthesizes context, a Regulatory Specialist validates thresholds/rules, and a Reporting Agent drafts SARs with citations. APIs coordinate tasks and data exchange, culminating in a complete, auditable case package.

Who can use this

- AML compliance teams and BSA Officers.

- Risk Ops & Fraud/Financial Crime units.

- RegTech builders and data teams.

- Internal audit and second-line risk.

- AI platform engineers.

Benefits

- Continuous monitoring with fewer false positives.

- Faster investigations and SAR turnaround.

- Standardized decision logs and evidence packs.

- Adaptive rules informed by feedback and typologies

- Easy scaling to peak volumes

Agents Required

Agent Name: Monitoring Manager Agent

Role & Capabilities: Oversees transaction ingestion, alert generation, and workflow routing using Syncloop APIs. Manages system orchestration, assigns analysis tasks, and tracks alert lifecycle for SLA compliance.

Agent Name: Sanctions/PEP/Adverse-Media Screening Agent

Role & Capabilities: Performs sanctions, PEP, and adverse media screening against OFAC, EU, and UN databases. Flags potential high-risk entities and provides contextual scoring with detailed match reasoning.

Agent Name: Graph & Network Analysis Agent

Role & Capabilities: Analyzes entity relationships to uncover hidden money flows and suspicious link patterns. Performs entity resolution and typology-based graph exploration for complex investigations.

Agent Name: AML Investigator Agent

Role & Capabilities: Aggregates alerts, screening results, and transaction histories into cohesive cases. Builds timelines, adds analyst notes, and generates recommendations for case escalation or closure.

Agent Name: Regulatory Knowledge Specialist Agent

Role & Capabilities: Fetches up-to-date AML, BSA, and FATF compliance standards. Validates whether case findings meet reporting thresholds and provides citation-based policy references.

Agent Name: SAR Drafting & Reporting Agent

Role & Capabilities: Generates structured SAR drafts using inputs from all agents. Compiles narratives, attaches supporting evidence, and prepares regulator-ready submission files with audit logs.

Syncloop API Usage

| Endpoint |

Method |

Input Parameters |

Output Format |

| /monitor/ingest |

POST |

{"batchId":"B123","transactions":[...]} |

{"ingested": true, "count": 2500} |

| /alerts/generate |

POST |

{"batchId":"B123","ruleset":"v4.2"} |

{"alerts":[{"id":"AL-001","score":0.92},...]} |

| /screen/entity Media Agent |

Posts |

{"alertId":"AL-001","entity":{"name":"...","dob":"...","country":"..."}} |

{"hits":[...], "pepTier":"2","adverseScore":0.67} |

| /graph/explore |

POST |

{"alertId":"AL-001","seedAccounts":["A123"],"depth":3} |

{"clusters":[...], "pathPatterns":[...]} |

| /case/assemble |

POST |

{"alertId":"AL-001","evidence":["screening","graph","txnSummary"]} |

{"caseId":"CASE-0091","timeline":[...]} |

| /regulation/validate Specialist |

GET |

{"topic":"CTR/SAR thresholds","jurisdiction":"US"} |

{"citations":[...],"notes":"Thresholds met: yes"} |

| /sar/draft Reporting Agent |

POST |

{"caseId":"CASE-0091","include":["timeline","counterparties","citations"]} |

{"sarId":"SAR-2025-113","previewUrl":"https://..."} |

| /sar/submit |

POST |

{"sarId":"SAR-2025-113","channel":"FinCEN"} |

{"status":"Submitted","receipt":"FCN-..."} |

Flow Summary

- Transactions ingested and alerts generated.

- Entities screened for sanctions/PEP/adverse media.

- Graph exploration surfaces patterns (structuring, smurfing, mule networks).

- Investigator compiles evidence and recommends disposition.

- Regulatory Specialist validates policy thresholds and citations.

- SAR Agent drafts and submits SAR with attachments.

- Manager closes case; artifacts stored for audit.

Optional Enhancements

- OCR Agent for image/PDF statements and IDs.

- Anomaly Detection Agent (unsupervised/LLM-assisted).

- Feedback-Learning Agent to tune rules and models.

- Dashboard & SLA telemetry for Ops.

Ideal (Key Performance Indicator) KPIs to Measure Success

- Alert-to-Case Conversion Rate (target: +20% precision)

- False Positive Rate (target: < 30% of baseline)

- Median Case Handling Time (target: −50%)

- SAR Turnaround Time (target: < 24 hours)

- Narrative Quality Score (reviewer-rated > 4.5/5)

- Evidence Completeness (checklist pass > 95%)