Problem Description

Financial institutions need 24×7 intelligent servicing that’s fast, personalized, and compliant. Incoming client requests across channels (chat, email, voice) often require sentiment-aware routing, RAG-enabled personalized advice, and strict compliance checks —a combination that’s hard to scale with humans alone. Automating this with a coordinated multi-agent system reduces cost, speeds response, improves CX, and prevents regulatory breaches while keeping human oversight where it matters.

Working of Template

- Ingest client messages from any channel.

- Classify sentiment & urgency to prioritize and route.

- Generate a context-aware response with RAG and KB access.

- Run compliance/privacy filters on outgoing content.

- Add personalized wealth/market insights where relevant.

- Dispatch notifications and create audit trails.

- Escalate to human agent when guardrails trigger.

Benefits

- 40%+ reduction in tier-1 service cost per interaction.

- Faster SLAs, improved CSAT, fewer compliance incidents, higher engagement & wallet-share.

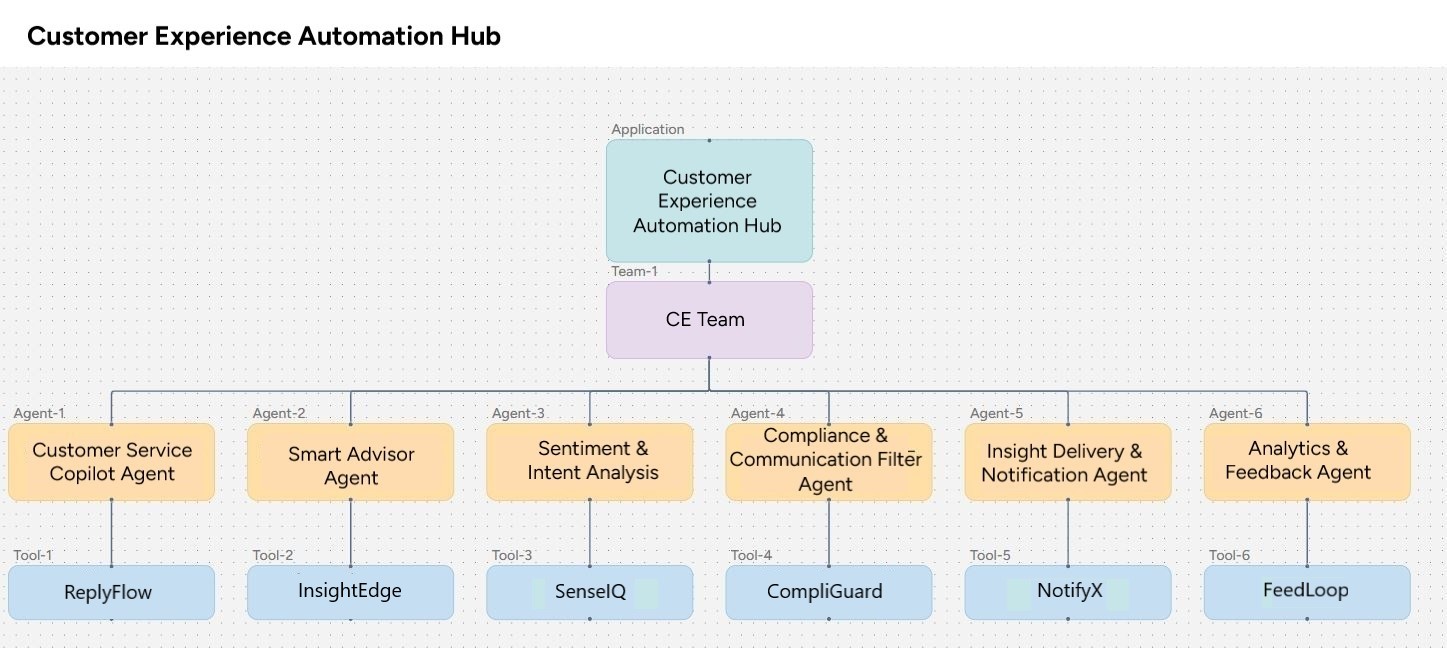

Agents Required

Agent Name: Customer Service Copilot Agent

Role & Capabilities: Retrieve KB content, fill templates, generate replies, log context, invoke Compliance Filter before send.

Agent Name: Smart Advisor Agent

Role & Capabilities: Fetch client profile, query RAG on docs/market KB, create insight snippets, attach sources.

Agent Name: Sentiment & Intent Analysis Agent

Role & Capabilities: NLU classification, confidence scoring, tagging, route decisions, SLA assignment.

Agent Name:Compliance & Communication Filter Agent

Role & Capabilities: Runs rule-based & ML filters, annotates required disclosures, returns pass/fail with suggestions.

Agent Name: Insight Delivery & Notification Agent

Role & Capabilities: Format messages per channel, call channel APIs, track delivery.

Agent Name: Audit & Human Escalation Agent (Optional but recommended)

Role & Capabilities: Assemble conversation bundle, present to UI/human, apply human resolution, update KB.

Agent Name: Analytics & Feedback Agent (Optional)

Role & Capabilities: Aggregate logs, compute KPIs, surface drift and feedback loops.

Syncloop API Usage

| Endpoint |

Method |

Input Parameters |

Output Format |

| /inbound/message |

POST |

{channel, client_id, message_text, metadata} |

{message_id, received_at, status} |

| /nlp/classify |

POST |

{message_id, text} |

{intent, sentiment_score, urgency, confidence} |

| /kb/retrieve |

GET |

?query=&client_profile_id= |

{results: [{doc_id, excerpt, score}], context_id} |

| /rag/generate |

POST |

{context_id, prompt, max_tokens} |

{generation_text, sources: [{doc_id, span}], score} |

| /compliance/check |

POST |

{outbound_text, client_id, channel} |

`{status: PASS |

| /notify/send |

POST |

{channel, client_id, message_payload} |

{notification_id, status, delivered_at} |

| /audit/log |

POST |

{message_id, agent_actions[], compliance_result, human_flag} |

{audit_id, stored_at} |

| /escalate/human |

POST |

{audit_id, reason, urgency} |

{case_id, assigned_to} |

| /analytics/report |

GET |

?start=&end=&metric= |

{metric, value, trend} |

| /kb/update |

PUT |

{doc_id, content, tags} |

{doc_id, version, updated_at} |

Flow Summary

- Client message POSTed to /inbound/message.

- Sentiment & Intent Agent calls /nlp/classify → assigns priority & route.

- Copilot calls /kb/retrieve and /rag/generate to draft reply.

- Draft forwarded to /compliance/check. If BLOCK → send to /escalate/human.

- If PASS → /notify/send dispatches message; /audit/log stores action.

- If client needs insights, Smart Advisor augments reply with /rag/generate using client profile.

- Analytics Agent queries /analytics/report to update KPIs and retraining datasets.

Optional Enhancements

- Add a Real-time Voice Agent for IVR+NN-based sentiment in calls.

- Integrate Market Data streaming for minute-level portfolio alerts.

- Add Federated Learning for on-prem client data privacy.

- Add automated KB self-update agent to ingest human-reviewed Q&A.

- Integrate a dedicated Fraud Detection API to block suspicious requests.

Ideal (Key Performance Indicator) KPIs to Measure Success

- First Response Time (target: < 30 seconds for chat).

- Resolution Rate by Bot (target: ≥ 65% for Tier-1).

- CSAT Score (target: +10 pts vs baseline).

- Compliance Pass Rate (target: 99.9% auto-pass).

- Cost per Interaction (target: −40%).

- Escalation Accuracy (human review needed ≤ 5% false positives)