Problem Description

Organizations face rapidly changing regulations (GDPR, FATCA, MiFID, etc.), voluminous filings, and high-stakes transaction monitoring. Manual review and siloed systems create compliance lag, missed risks, and costly remediation. This template automates continuous monitoring, structured regulatory knowledge, document extraction, anomaly detection, and submission preparation using a coordinated multi-agent network—reducing time-to-compliance and surfacing proactive regulatory insights.

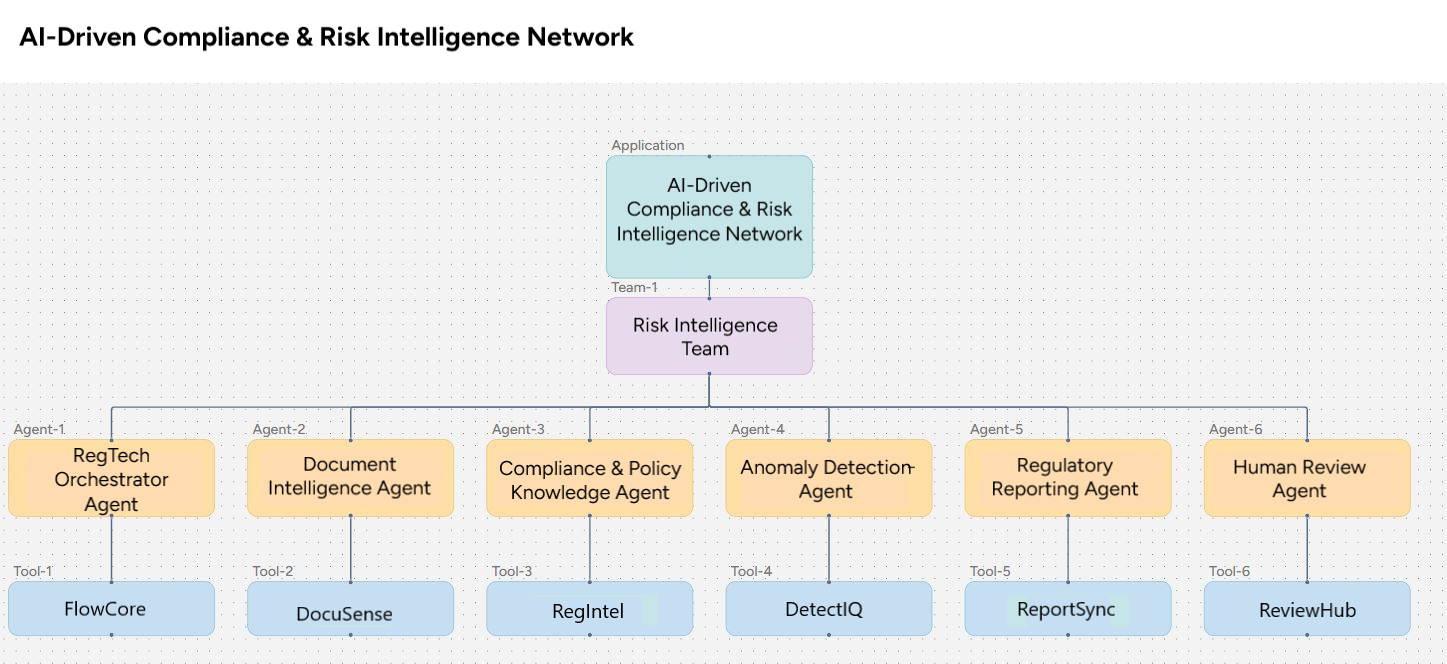

Working of Template

A central Orchestrator ingests incoming data (transactions, reports, emails). It routes documents to Document Intelligence for extraction, then queries the Compliance & Policy Knowledge Agent to validate extracted facts against current rules. Anomaly Detection runs behavioral and rule-based checks; flagged items trigger review workflows and, when cleared, Regulatory Reporting auto-prepares and submits filings. All interactions occur via Syncloop APIs with logging, versioning, and traceable decision records.

Benefits

- Continuous, auditable compliance monitoring.

- Faster data capture and filing generation.

- Early detection of fraud and policy violations

- Reduced manual review and regulatory lag

Agents Required

RegTech Orchestrator Agent

Syncloop API Usage

| Endpoint | Method | Input Parameters | Output Format |

|---|---|---|---|

| /orchestrator/ingest | POST | { source_type, source_id, payload_url, metadata } | { job_id, status } |

| /orchestrator/route | POST | { job_id, target_agent, priority, context } | { routed: true, queue_id } |

| /docint/process | POST | { document_url, schema_hint, languages } | { doc_id, fields: {...}, confidences: {...} } |

| /kb/query | POST | { transaction_batch_id, features } | { scores: [{id, score, reason}], top_flags: [...] } |

| /report/generate | POST | { filing_type, validated_data, submission_meta } | { report_id, file_url, validation_errors: [] } |

| /report/validate | POST | { report_id } | { valid: bool, issues: [...] } |

| /human/review | GET/POST | GET { task_id } POST { task_id, decision, comments } | { review_status } |

| /audit/collect | POST | { job_id, artifacts: [...] } | { audit_bundle_id, signed_hash } |

| /kb/update | PUT | { regulation_id, change_payload, source_link } | { update_id, status } |

| /orchestrator/notify | POST | { channel, message, recipients } | { notify_id } |

Flow Summary

- External input (transaction feed, filing, email) → POST /orchestrator/ingest.

- Orchestrator routes document → /docint/process.

- Document Intelligence returns structured fields + confidence.

- Orchestrator calls /kb/query to validate extracted facts against KB rules.

- Orchestrator sends transaction data to /anomaly/score.

- If anomalies or KB validation fails → create human review task /human/review.

- Human approves/annotates → Orchestrator triggers /report/generate.

- Regulatory Reporting runs /report/validate; if valid, produce submission package.

- Audit & Evidence Agent calls /audit/collect to create signed audit bundle.

- Orchestrator notify stakeholders and store full trace in Syncloop KB + logs.

Optional Enhancements

- Add a Model Retrainer Agent that periodically retrains anomaly models using confirmed cases.

- Integrate Legal Feed Agent to pull regulator advisories and auto-suggest KB patches.

- Connect Threat Intelligence APIs for sanctions/PEP lists and real-time watchlist updates.

- Add Explainability Agent to produce human-readable rationales for ML decisions.

Ideal (Key Performance Indicator) KPIs to Measure Success

- Time-to-Validation: reduction in hours/days to validate filings.

- Data Capture Accuracy: % of extracted fields above confidence threshold.

- False Positive Rate: % of anomaly flags cleared by humans.

- Filing Error Rate: % filings rejected by regulators.

- Compliance Lag: days between regulation change and KB update.

- Audit Readiness: % of submissions with complete audit bundle.

Related Templates

Transaction Monitoring & AML Case Automation

Automation / Finance / Compliance

Fintechs must continuously detect, investigate, and report suspicious activity across high-volume transactions.

Digital KYC & CIP Orchestration with Risk-Based Tiering

Automation / Finance / Identity

Onboarding demands fast, accurate identity verification across documents, liveness, address proofs, and database checks.

Vendor Optimization & Procurement AI System

Finance / Supply Chain / Retail

A scalable multi-agent AI system tailored for an American restaurant specializing in Mexican cuisine, orchestrated on Syncloop.